Netflix sues state over tax on streaming service

Netflix is suing the Arizona Department of Revenue after the department levied a transaction privilege tax on its streaming service.

Bill creates needed framework to tax digital goods and software

Did anyone else notice their bill for cloud storage went up last year because a sales tax (TPT) suddenly appeared? As an association who follows state tax law closely, we wondered what law or rule changed. It turns out nothing changed. Bureaucrats at the state simply decided to start taxing the cloud.

The cost of cuts: Arizona tax carve-outs last year hit $13.7B

In fiscal year 2016, state law allowed $13.7 billion in taxes to go uncollected through a litany of exemptions, deductions, allowances, exclusions or credits. And that number is likely to grow by another $1-to-2 billion once individual income tax deductions are tallied.

House Speaker: Budget deal is ‘close’

House Speaker J.D. Mesnard said negotiators are close to finalizing a spending plan for Fiscal Year 2018, and while a deal isn’t set yet, there is a 50-50 chance that budget bills will be introduced by the end of the day today.

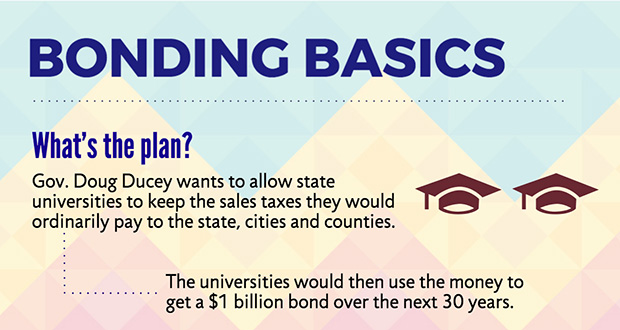

Ducey’s bonding plan for universities has more questions than details

Gov. Doug Ducey’s university bonding proposal is a vast unknown for Arizona lawmakers.

Ducey orders tax agency not to collect taxes despite veto

In a legally questionable move, Gov. Doug Ducey is ordering the Department of Revenue not to collect hundreds of thousands of dollars in sales taxes against certain types of businesses that the agency -- and even a court -- says are owed to the state.

New TPT law takes effect, but changes are likely

How much headache can a barrel of screws create? A lot – if you bought them before Jan. 1, 2015, and you happened to be a subcontractor.

TPT reform provision put on hold for 1 year

The Arizona Department of Revenue will delay the implementation of a key provision of Gov. Jan Brewer’s transaction privilege tax reform package because it cannot get a new electronic portal ready in time.

Brewer nixes special session request on TPT

Gov. Jan Brewer won’t call a special session requested by a contractors’ industry group to postpone the implementation of her 2013 transaction privilege tax reform law.

Brewer set to sign sales tax overhaul bill

Gov. Jan Brewer is set to sign a major overhaul of the state's sales tax collection system after compromising with cities and towns that worried it would cut their revenue.

Brewer, league compromise on sales tax reform, but still no deal

Gov. Jan Brewer made a major concession to her transaction privilege tax reform bill that eliminates the most contentious provision, but that wasn’t enough to get the League of Arizona Cities and Towns on board.

Tax simplification should not hurt cities

The East Valley Partnership recognizes the need to streamline and improve our state’s tax system. That is why we support the major tenets of Gov. Jan Brewer’s plan to reform Arizona’s Transaction Privilege Tax (TPT) that is currently burdensome for businesses and puts local merchants at a disadvantage to out-of-state Internet retailers.