It’s up to lawmakers to decide whether to OK vote on jail tax

Jakob Thorington Arizona Capitol Times//January 3, 2025//

It’s up to lawmakers to decide whether to OK vote on jail tax

Jakob Thorington Arizona Capitol Times//January 3, 2025//

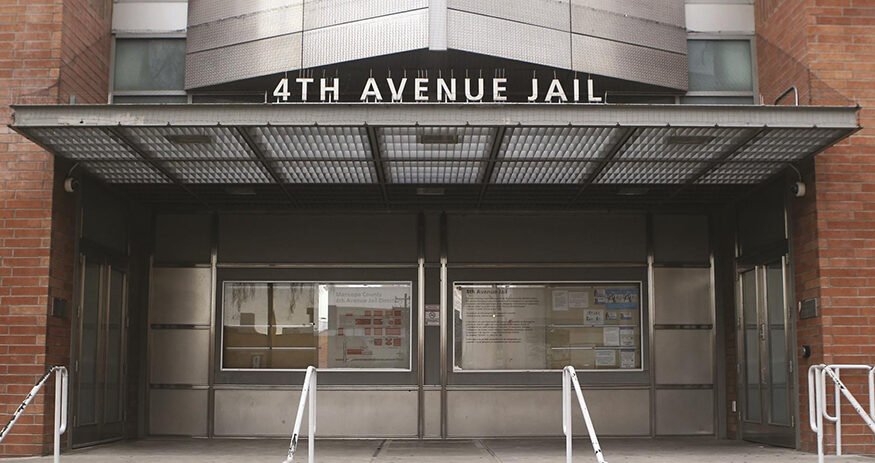

Maricopa County officials are hoping lawmakers will allow voters to consider extending a nearly 30-year old half-cent sales tax that funds jails next election.

The county’s jail excise tax is similar to the transportation excise tax, which voters just renewed with the passage of Proposition 479, the half-cent sales tax used to fund transportation infrastructure. The jail tax expires in 2027, but the county is unable to put it on the ballot to renew the tax without approval from the Legislature.

Members of the county’s Public Safety Funding Committee recently recommended the Board of Supervisors to pursue a 20-year extension of the tax at its current rate of one-fifth of one cent.

“The Jail Excise Tax brings in about $300 million in revenue per year and has been an effective way of funding our public safety needs as the county grows, at a low burden to the individual taxpayer,” said Supervisor Clint Hickman in a Dec. 16 news release. “I agree with the committee’s recommendation that an extension of the tax, at the current rate, is the best way to make sure we continue to live in a safe community where people can thrive economically.”

County voters first approved the tax in 1998, and it was extended in 2002. With an expiration date of March 2027, the Legislature will need to address the issue either in the upcoming session or in 2026.

Since the tax has been implemented, the county has received more than $3.6 billion in revenue that has been allocated to jails. More than 40% of the county’s detention fund comes from the jail tax, which saw $270 million in revenue from 2023.

During a Board of Supervisors meeting on Dec. 9, Hickman said he has reminded lawmakers of the jail tax’s importance for at least 10 years since U.S. Rep. Andy Biggs, R-Ariz, was president of the state Senate.

“It’s extremely important to this extremely conservative, fiscally prudent board that our Legislature understands what’s going to be asked from them,” Hickman said. “So many times I’ve seen this can kicked down the road for people to make hard decisions when it comes to fiscal prudence, so I hope they listen with all ears open.”

Republican leadership in the House didn’t comment on if they would pursue putting an extension question on the ballot in the upcoming session.

If Republicans do pursue an extension, it must also be a plan supported by Gov. Katie Hobbs. The Governor’s Office was at odds with Republicans early in negotiations over the renewal of the transportation tax, largely over funding distribution for public transportation.

Maricopa County is the only county in the state that must go through the Legislature to put a sales tax on the ballot.

“Extending the tax at the current rate makes sense to me because it ensures a consistent funding source for critical public safety needs,” Supervisor Bill Gates said in a news release.

An October report from Rounds Consulting Group determined that failing to extend the jail tax could result in increased local taxes and diminished public safety.

County officials could increase property taxes or service fees to make up for the lost revenue, but neither is a desirable option for the mostly Republican Board of Supervisors.

Another option Rounds outlined is to create a special taxing district, but the consulting group warned these districts are often complex to manage and that could have uneven financial impacts to residents.

Incoming House Minority Leader Oscar De Los Santos, D-Laveen, told 3TV that House Democrats support sending the jail tax extension to voters.