Republicans vote to cut nearly half the taxes corporations owe

Saying it will stimulate job growth, Republican lawmakers voted Tuesday to cut by nearly half the taxes owed by corporations doing business in Arizona.

Ducey sends $400M of CARES money to state agencies

Gov. Doug Ducey is using hundreds of millions of dollars in federal funds earmarked for COVID-19 relief to pay for state operations, such as salaries, which some say contravenes the... […]

Report: High cigarette tax fuels black market in Arizona

A cigarette tax higher than neighboring states and cheaper prices on American Indian reservations have helped fuel a growing a black market for cigarettes in Arizona, according a study by a Washington, D.C., think tank.

Report: AZ gets close to half of revenue from feds, near top in nation

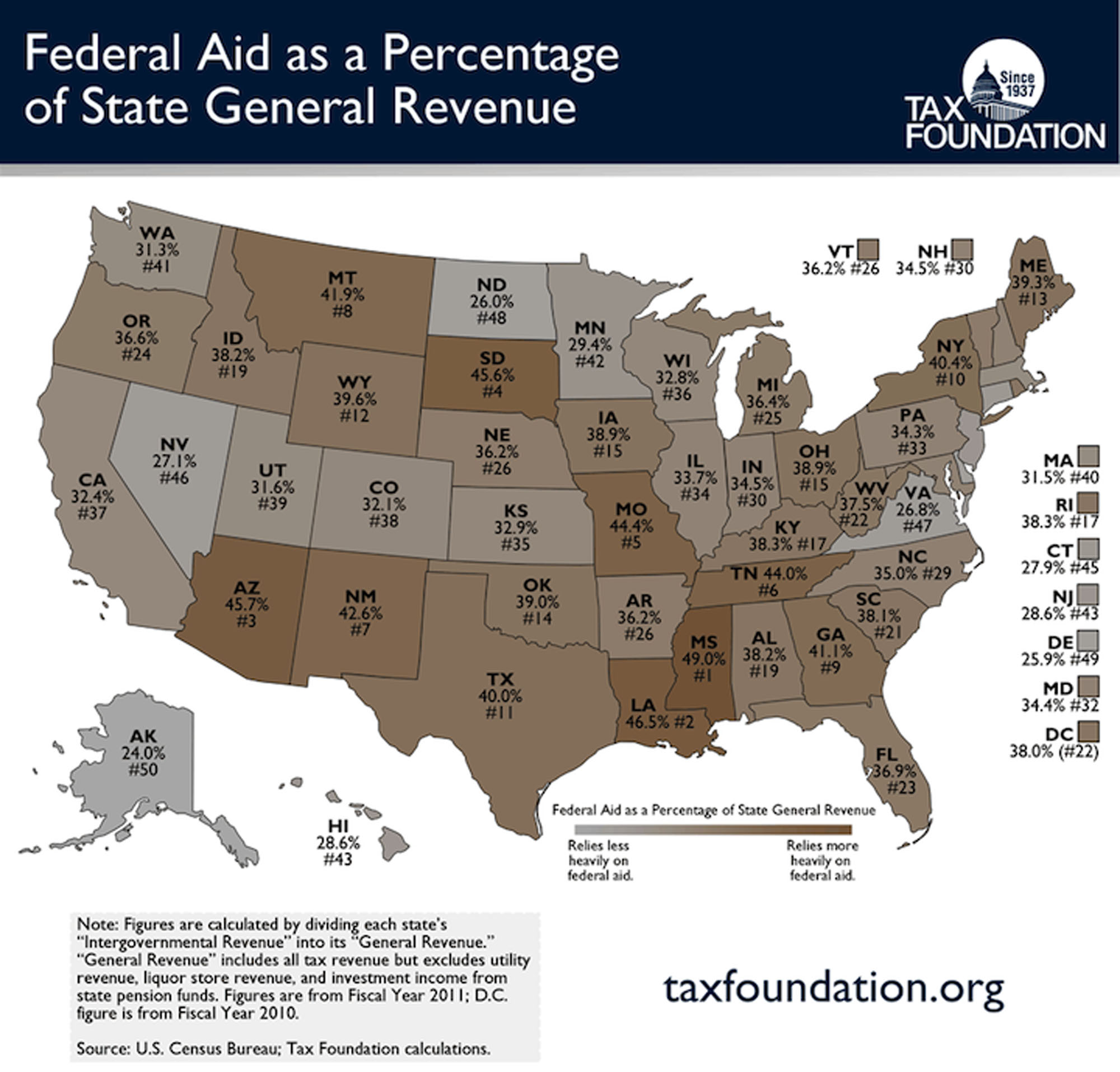

Almost half of Arizona’s general revenues came from federal funds in fiscal 2011, the third-highest share in the nation, according to a recent report from the Tax Foundation.

Report: State gets close to half of revenue from feds, near top in nation

WASHINGTON – Almost half of Arizona’s general revenues came from federal funds in fiscal 2011, the third-highest share in the nation, according to a recent report from the Tax Foundation.

Arizona’s combined sales tax rate is second-highest in the nation

Vans Trading Co. has been around since 1946, but it’s only in the last decade that customers at the Tuba City general store have yelled at the cashiers after they get their receipts.

Arizona can’t afford to be a ‘C’ student any longer

As a place to do business and in matters related to public policy, personal freedom and taxation, Arizona is a solid “C” student. But can it afford to stay that way?

Southwest states’ tug of war with film subsidies

Ken Chapa can still remember his first trip to Grand Canyon National Park. Gazing over the majestic vista, he said he immediately connected it to one of his favorite Chevy Chase movies, "National Lampoon's Vacation."

Report ranks Arizona ninth nationally in state, local reliance on sales taxes

Arizona ranks ninth nationally in its reliance on sales taxes to fund its state and local governments, according to a report by a nonpartisan tax research organization. The Washington, D.C.-based Tax Foundation found that 48.4 percent of Arizona's tax base came from general sales taxes and from selective sales taxes on motor fuel, tobacco, insurance premiums, public utilities, amusements and al[...]