Tax relief renters’ gain, cities’ loss

Howard Fischer, Capitol Media Services//December 13, 2024//

Arizona renters are in for a bit of a break in their monthly payments to landlords – if the law works the way it’s been advertised.

Effective Jan. 1, cities can no longer charge sales taxes on residential rentals. While not all communities now have such a levy – Tucson for example, does not – 75 of the 91 cities in the state do at rates ranging from 1% to 4%.

And what that also means is that, come January, the affected cities collectively will lose about $230 million a year.

It’s been a long time coming. In fact, Gov. Katie Hobbs vetoed the repeal the first time it came to her desk in 2023, saying it suffered from defects.

One of the biggest, she said, is there is no “enforceable mechanism” to ensure that landlords, who actually remit the tax to the cities, actually will pass along the savings to their tenants rather than just keep collecting the same amount every month and pocketing the difference.

Nor was the governor swayed by the fact that the measure had language that would have required landlords to reduce the rent due by an amount equal to what they are no longer paying to cities. Hobbs claimed that even an attorney for lawmakers said that such a provision may not withstand a challenge under the state or federal constitutions.

But by August, Hobbs had changed her mind.

So what’s different?

The measure still has the same language as the version she vetoed about landlords being required to pass along the tax savings to tenants. But it also includes a provision that says if there’s a civil suit, presumably filed by an unhappy tenant who believes he or she is being overcharged, the burden is on the landlord to show that none of the rent being charged is attributable to the levy once it disappears.

Then there’s timing.

Acknowledging the concerns about lost city revenues, the 2023 law was designed with a delay to give communities a chance to figure out how to either make up the difference from other sources or find places to cut their budgets. That’s why the repeal doesn’t take effect until the end of this year.

And there was something else: a link to the whole debate over extension of the transit sales tax for Maricopa County.

State law requires Maricopa County – and only Maricopa County – to get legislative approval to seek an extension of the half-cent levy that pays for roads and mass transit. Republican leaders confirmed that there was an understanding that if they approved allowing the tax extension to go to a public vote in a form acceptable to Hobbs, then she would sign the measure they wanted repealing the rental tax.

The deal was made and Prop 479 went on the ballot last month and was approved.

What cities did not get, though, was some “backfill” by the state to compensate them for the lost revenues.

That did not bother Senate Republicans when they pushed the legislation last year.

At a press conference, several said they believed the cities were flush with cash and criticized them for not voluntarily eliminating the rental tax, something they said was necessary to help low-income renters during a period of high inflation.

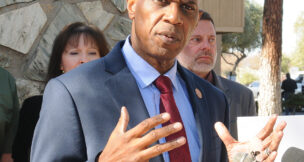

“This is (money) to help people put food on the table, give them an extra tank of gas in the car,” said Senate President Warren Petersen, R-Gilbert. “And we are ready to provide relief.”

House Majority Whip Teresa Martinez, who has several cities in her district that are affected, acknowledged Friday that voting for the 2023 legislation provided her with some heartburn.

“On one hand, I don’t believe the state should tell the cities what to do,” said the Casa Grande Republican, comparing it to the federal government dictating to the state.

But she said that has to be weighed against the benefit to tenants. And Martinez said she believes the bill, as finally approved, provides sufficient assurance that the renters will get some relief and landlords will not simply pocket the difference.

As to the effect on cities – like Casa Grande with an anticipated $1.2 million annual impact – Martinez said the lost revenues will have a significant impact.

“But it didn’t kill them,” she said. Still, Martinez said she remains open to having a conversation with the affected communities.

Cities with rental tax and rates:

Apache Junction — 2.2%

Avondale — 2.5%

Benson — 2.5%

Bisbee — 3.5%

Buckeye — 2.0%

Camp Verde — 2.0%

Carefree — 3.0%

Casa Grande — 1.8%

Cave Creek — 3.0%

Chandler — 1.5%

Chino Valley — 3.0%

Clarkdale — 3.0%

Clifton — 3.0%

Colorado City — 2.0%

Coolidge — 3.0%

Cottonwood — 3.0%

Dewey-Humboldt — 2.0%

Douglas — 2.8%

Duncan — 2.0%

Eagar — 3.0%

El Mirage — 3.0%

Eloy — 3.0%

Florence — 2.0%

Fountain Hills — 1.6%

Fredonia — 4.0%

Gila Bend — 3.0%

Gilbert — 1.5%

Glendale — 2.2%

Goodyear — 2.5%

Guadalupe — 3.0%

Hayden — 3.0%

Holbrook — 3.0%

Huachuca City — 1.0%

Jerome — 3.5%

Kearny — 2.5%

Kingman — 2.0%

Litchfield Park — 2.8%

Mammoth — 2.8%

Maricopa — 2.0%

Mesa — 2.0%

Miami — 2.5%

Nogales — 2.0%

Page — 3.0%

Paradise Valley — 1.65%

Parker — 2.0%

Patagonia — 3.0%

Peoria — 1.8%

Phoenix — 2.3%

Pima — 2.0%

Pinetop-Lakeside — 3.0%

Prescott — 2.0%

Queen Creek — 2.25%

Sahuarita — 2.0%

San Luis — 4.0%

Scottsdale — 1.75%

Sierra Vista — 1.0%

Somerton — 3.0%

South Tucson — 2.5%

Springerville — 3.0%

St. Johns — 2.0%

Star Valley — 2.0%

Superior — 2.0%

Surprise — 2.2%

Taylor — 2.0%

Tempe — 1.8%

Thatcher — 2.0%

Tolleson — 2.5%

Tombstone — 2.5%

Wellton — 2.5%

Wickenburg – 1.7%

Williams — 3.0%

Winkelman — 3.5%

Youngtown — 2.0%

Yuma — 1.7%

— Source: Arizona Department of Revenue